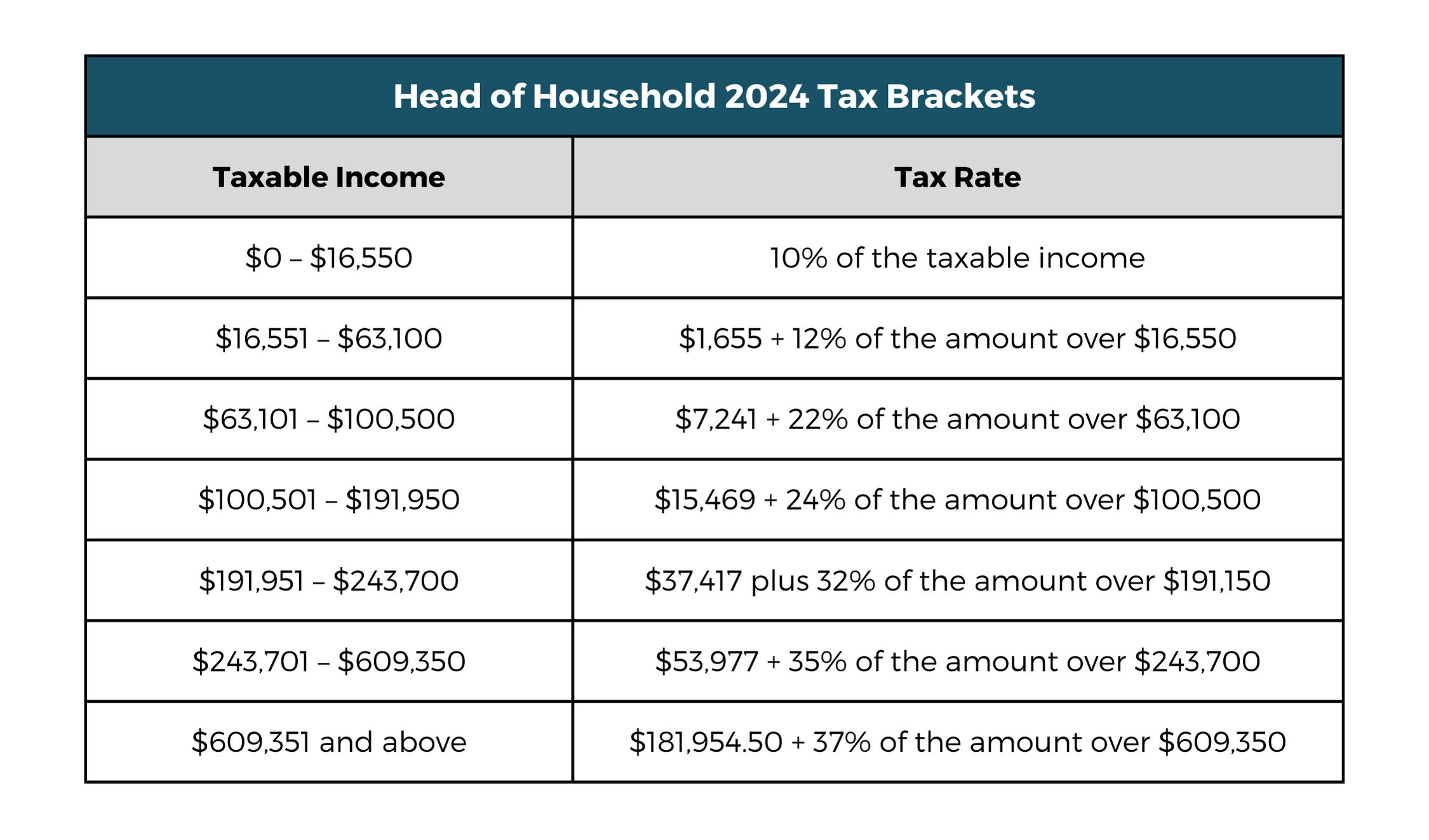

Tax Brackets 2025 Head Of Household Married Jointly. The 2025 federal income tax brackets and tax look a little different than 2025 brackets. Thankfully, the irs released the income tax brackets for 2025 last year,.

Thankfully, the irs released the income tax brackets for 2025 last year,. Choose from one of the four tax filing statuses available (single, head of household, married filing separately, or married filing jointly).

Tax Brackets 2025 Irs Single Elana Harmony, Tax rate single head of household married filing jointly or qualifying widow married filing separately; The 2025 standard deduction amounts are as follows:

Tax Filing 2025 Usa Latest News Update, Choose from one of the four tax filing statuses available (single, head of household, married filing separately, or married filing jointly). For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Effective Tax Bracket Calculator 2025 Lira Valina, Filing options include single, married filing jointly, married filing separately, head of household and qualifying widows and widowers. Tax rate single married filing jointly married filing separately head of household;

2025 Tax Code Changes Everything You Need To Know RGWM Insights, Tax rate single head of household married filing jointly or qualifying widow married filing separately; Rate married filing jointly single individual head of household married filing separately;

2025 Federal Tax Brackets And Rates Rasla Cathleen, Single, married filing jointly, married filing separately or head of household. Tax rate single head of household married filing jointly or qualifying widow married filing separately;

2025 Irs Tax Brackets Married Filing Jointly Cammi Rhiamon, The 2025 federal income tax brackets and tax look a little different than 2025 brackets. We've got all the 2025 and 2025.

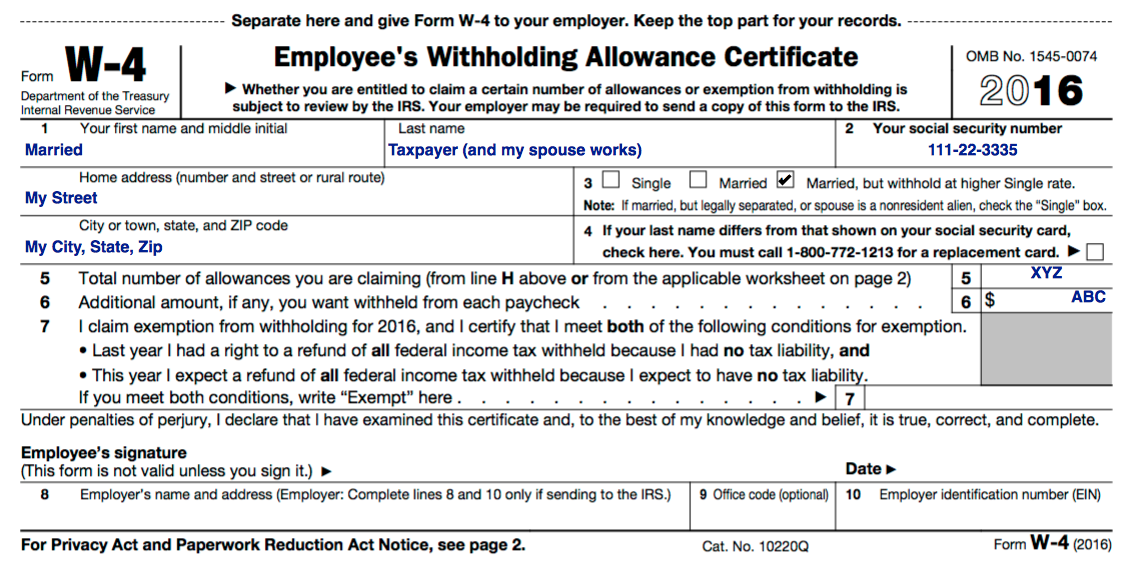

How To Fill Out W 4 Form Married Filing Jointly 2025 Printable Forms, Tax rate single filers married filing jointly or qualifying widow(er) married filing separately head of household; The 2025 standard deduction amounts are as follows:

Tax Tables Married Filing Jointly Printable Form Templates And Hot, 2025 marginal tax rates by income and tax filing status; Single filers and married couples filing jointly;

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

2025 Tax Brackets And The New Ideal, Single filers and married couples filing jointly; Single, married filing jointly, married filing separately or head of household.

The Best Us Tax Rates 2025 References finance News, You pay tax as a percentage of your income in layers called tax brackets. The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax rate single head of household married filing jointly or qualifying widow married filing separately;