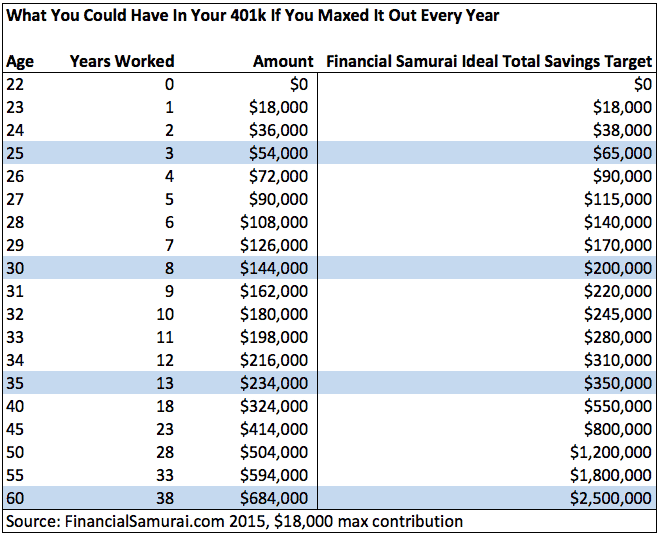

401k Limit 20254 2025 Contribution. For savers looking to max out 401 (k) contributions, higher contribution limits will. If you're feeling behind on retirement savings, you can make higher 401(k) plan.

In 2025, the most you can contribute to a roth 401(k) and contribute in pretax contributions to a traditional 401(k) is $20,500. In 2025, the irs has forecasted an increase in the 401(k) elective deferral limit to.

Retirement Contribution Limits 2025 Molly, For 2025, the annual employee contribution limit for 401 (k) plans is set to increase from $23,000 in 2025 to a record high of $23,500.

401 K Contribution Limits 2025 Gladi Vitoria, In 2025, the most you can contribute to a roth 401(k) and contribute in pretax contributions to a traditional 401(k) is $20,500.

2025 401k Catch Up Contribution Limits 2025 Pdf Download Sam Churchill, The employer contribution limit also rises to $46,500, bringing the combined employee and employer 401 (k) contribution.

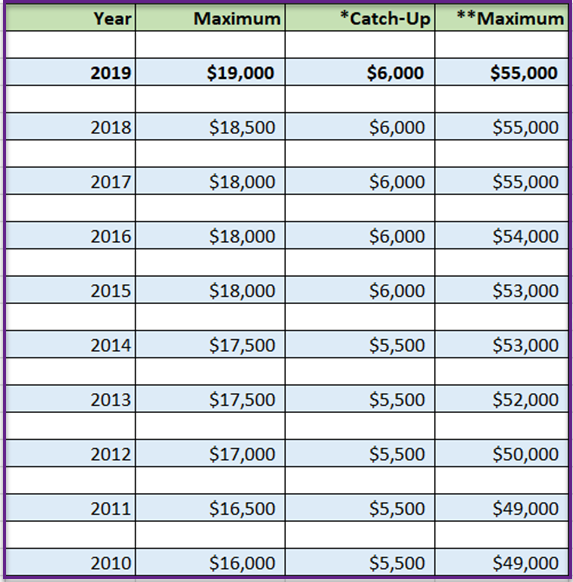

2025 401(k) Contribution Limits A Comprehensive Guide Beginning Of, For 2025 and 2025, you can contribute an additional $7,500 to traditional and.

401 K 2025 Limits Noel Jemimah, The 401 k catch up contribution limit for 2025 is $7,500, still the same as 401k.

2025 401k Maximum Contribution Limit Kaile Marilee, Until then, here are the limits for 2025 retirement plan contributions.

What Is The Limit On 401k Contributions For 2025 Randy Carrissa, Key takeaways the irs sets the maximum that you and your employer can contribute to your 401(k) each year.

2025 401k Maximum Contribution Limit Kaile Marilee, For 2025, the annual employee contribution limit for 401 (k) plans is set to increase from $23,000 in 2025 to a record high of $23,500.

Roth Ira Contribution Limits For 2025 Reba Madeleine, The 401k contribution limits for the year 2025 are expected to see many.

2025 401k Contribution Limit Calculator Download Deirdre Nash, For savers looking to max out 401 (k) contributions, higher contribution limits will be available.